NVIDIA is the first company in the semiconductor sector to reach a valuation of $1 trillion. While the company owes its success partly to the promising prospects of generative AI, the Microsoft-Activision deal may help the company growing in the gaming sector.

Although NVIDIA’s gaming revenue for fiscal year 2023 experienced a decline of 27% compared to 2022, the outlook for the remainder of the year and 2024 appears more favorable. This may be attributed, in part, to the potential benefits arising from the $75 billion Microsoft-Activision deal. While one might initially assume that this deal could harm NVIDIA and reinforce Microsoft’s dominance in the market, it may actually assist NVIDIA in expanding its market share and boosting revenue in the cloud gaming domain.

The deal’s fate currently hangs in the balance, as a US judge has temporarily halted its closure at the request of the Federal Trade Commission (FTC). A hearing is scheduled for June 22-23. Furthermore, the deal is also under review by the Competition Appeal Tribunal (CAT) in the United Kingdom.

Interestingly, the merger review in the UK has shed light on relevant details regarding NVIDIA’s market share in the cloud gaming market and its recent agreement with Microsoft. According to the UK Competition and Markets Authority (CMA), NVIDIA GFN (GeForce) holds a market share of 20-30% for cloud gaming services globally, based on average Monthly Active Users (MAUs). Although this figure still falls short of Microsoft’s dominant market share of 50-60%, it significantly surpasses Sony’s Play Station cloud gaming share of 10-20%.

If we were to rely on Microsoft’s estimations of market shares, NVIDIA’s market share would range from 50% to 60%, according to the data submitted to the regulator. The regulator’s decision presents varied market shares for different services, both paid and unpaid, and across different regions such as the UK. Generally, NVIDIA lags behind Sony and Microsoft in terms of paid services.

Of note is the distinction made by the regulator when describing the console market, which consistently features the same three main competitors: Microsoft’s Xbox, Sony’s PlayStation, and Nintendo’s Switch, with no other significant contenders. However, the landscape changes in the realm of cloud gaming, where emerging players like NVIDIA GFN and Boosteroid could play a vital role in this nascent yet rapidly expanding market.

Market sources estimate the value of the cloud gaming market at $6 billion in 2023, with a projected growth reaching $85 billion by 2030.

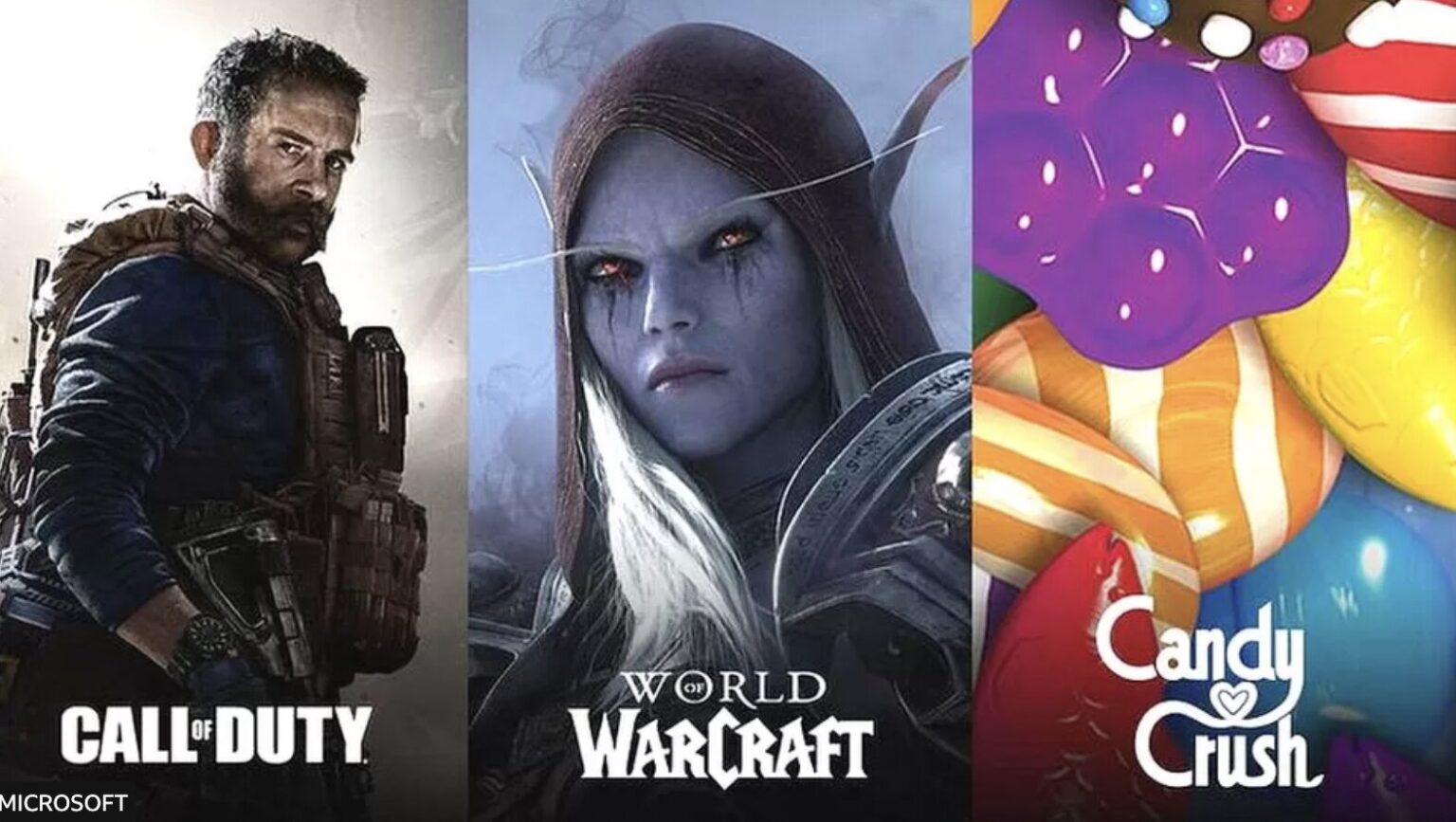

For any company to thrive in the cloud gaming industry, it must offer captivating content and games that attract players and developers. In the absence of the Microsoft-Activision merger, NVIDIA would unlikely gain access to blockbuster games such as Call of Duty and other future titles developed by Activision. It would have to rely solely on its own creations and licensing agreements with other parties.

However, this situation may change as a result of the merger. In their efforts to obtain regulatory approvals in the UK and Europe, Microsoft and Activision proposed a remedy package that includes granting access to Activision’s existing and future PC games for a period of ten years to NVIDIA and other cloud gaming providers. In the UK, this ten-year license, offered by Microsoft and Activision, is limited to only three cloud gaming providers: NVIDIA, Boosteroid, and Ubitus. Although this limitation to three providers is currently subject to discussion in court, it could potentially offer NVIDIA an additional advantage.

The deal faces significant challenges in court, and approval is not guaranteed. Nevertheless, if the parties ultimately succeed in closing the deal and execute these agreements, NVIDIA would gain access to a broad range of gaming content, which could enable it to expand its current market share of 20-30%.

Yet, as the CMA pointed out, agreements may be renegotiated or terminated early, and this led the regulator to not accept the commitments (and other reasons like the limitation of the license to just three cloud gaming providers).

These agreements between Microsoft-Activision and NVIDIA are intricately linked to the outcome of the deal. Hence, if Microsoft and Activision fail to complete the deal, NVIDIA’s chances of securing the ten-year license would diminish. Nevertheless, these negotiations between the parties, which have emerged as a result of regulatory scrutiny, suggest that licensing agreements may pave the way forward in this nascent market.