GXO was the second company added to the Antitrust Investor Portfolio.

In 2024, GXO began the process of acquiring Wincanton, a major UK logistics provider. The merger review quickly became more complex than expected: the UK regulator’s initial stance was notably skeptical, raising the prospect of a potential prohibition.

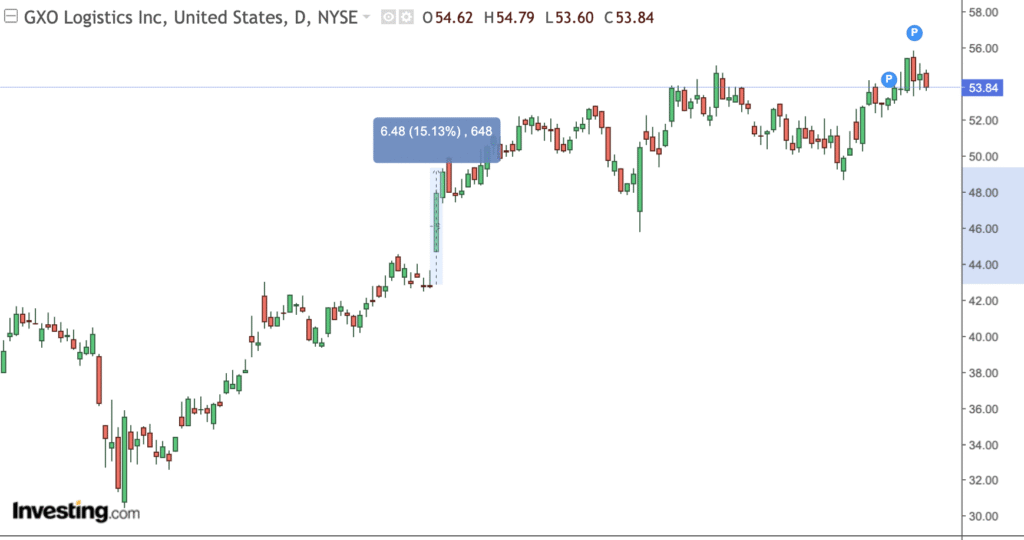

Our assessment, however, suggested that such a hard-line outcome was unlikely. The concerns raised by the authority could be resolved through targeted remedies, rather than a full block. Yet, as the review dragged on, investor sentiment soured and GXO’s share price fell sharply—at one point losing nearly half its value.

As the investigation progressed, our conviction grew that the deal would eventually clear (with conditions). Once that regulatory cloud lifted, the stock rebounded strongly, validating our thesis that regulatory overreaction often creates market opportunities.

From a fundamental perspective, our analysis found a robust company with near-dominant positions in the UK and growing exposure in other EU markets. In the UK—its main revenue source—GXO is the preferred logistics partner for leading supermarket chains and recently secured a $2.5 billion contract with the National Health Service (NHS). Combined with a solid client base and a healthy pipeline, GXO’s plans to automate a majority of its warehouses make it a long-term efficiency play as much as a regulatory one.

REGULATORY EVENT

On June 19, 2025 GXO Logistics obtained the regulatory approval to close UK’s Wincanton’s acquisition subject to the divestiture of a few warehouses. According to GXO’s CEO the divestitures represented less than 6% of Wincanton’s assets and the company raised its FY25 guidance to reflect the positive news. The impact on the stock price was almost instant.

What was the deal?

GXO Logistics, a global contract logistics provider, acquired Wincanton, a UK-based supply chain and logistics company. The deal was meant to strengthen GXO’s presence in the UK market, especially in warehouse and distribution services. However, the UK’s Competition and Markets Authority (CMA) raised concerns that the merger could reduce competition, particularly in the grocery logistics sector. This scrutiny, among other events, has led to financial uncertainty for GXO, with credit downgrades and stock price pressure, even though the competition concerns seem to affect only a small part of Wincanton’s business

Phase 1 Investigation: Initial Concerns

In its Phase 1 investigation, the CMA expressed concerns that the merger could substantially lessen competition in the UK’s mainstream contract logistics services market. The authority noted that GXO and Wincanton were two of the three primary suppliers in this sector, suggesting that their consolidation might reduce competition and elevate prices for customers, particularly large retailers. This market definition was broader than the one stated in the second phase investigation, which may have spooked investors about the future of the deal or the scope of any potential remedy.

Phase 2 Investigation: Narrowed Focus

Subsequently, the CMA’s Phase 2 investigation refined its focus, identifying potential competition concerns specifically in the supply of dedicated warehousing services to grocery customers. Leaving out of the hook shared warehousing and other dedicated warehousing for retailers. The affected segment represents less than 10% of Wincanton’s revenue, indicating that the majority of the business was not problematic. While these antitrust concerns were still significant, they make the prospect of a workable solution much more achievable.

This is when we decided to include GXO in our portfolio, as we believed a satisfactory resolution was within reach.

Our conclusion back in April was clear: after gathering feedback from all key stakeholders, a full clearance or purely behavioural remedies looked unlikely. Instead, a limited structural remedy—a small carve-out—appeared the most probable outcome. Crucially, such a remedy would leave the strategic rationale and expected synergies of the deal intact.

The assessment proved accurate. In June, the merger was approved with conditions, paving the way for GXO to consolidate its leadership in the UK logistics market.

COMPANY ANALYSIS

GXO Logistics may not own fleets of trucks or ships, but it sits at the center of the global movement of goods. Born in 2021 from the spin-off of XPO Logistics, the Connecticut-based company has become one of the world’s largest contract logistics providers—running warehouses, fulfillment centers, and reverse-logistics hubs for blue-chip clients such as Apple, Nike, Nestlé, and Inditex.

Its real edge lies in automation. GXO’s warehouses are packed with robots that pick, move, and pack goods under the coordination of proprietary algorithms designed to optimize labor and inventory flows. The company estimates that more than a third of its sites now use advanced automation or robotics—an area where it invests heavily to maintain productivity and margins in a sector where price competition is fierce and labor costs keep rising.

The business model is capital-intensive but sticky: clients usually sign multi-year contracts and embed GXO’s systems deep into their supply chains, making switching costly.

Financial Performance: Growth with Thin Margins

In financial terms, GXO is growing fast—but not without stress on profitability.

Revenue reached roughly $11.7 billion in 2024, up almost 20% year-on-year thanks to the acquisition of UK rival Wincanton and steady organic growth around 4%. The company reaffirmed guidance for 2025 revenue between $12 billion and $12.4 billion, driven by demand from e-commerce, healthcare, and consumer-goods sectors.

Yet, profitability remains tight. GXO’s adjusted EBITDA for 2024 was about $820 million, translating into a margin near 7%, which is modest compared with asset-lighter tech peers. Net income fell to $138 million, down from $233 million a year earlier, mainly due to higher interest costs and integration expenses from recent acquisitions.

Cash generation has also been volatile: free cash flow turned negative in early 2025 as working-capital needs and automation capex rose. Leverage sits near 6× net debt-to-EBITDA, a level that limits flexibility if demand cools.

Analysts see returns on invested capital below 3%, suggesting GXO still needs to demonstrate that its growth translates into economic value creation rather than scale for scale’s sake.

Strengths

- Automation leadership. GXO’s deep investment in robotics and predictive analytics is a genuine differentiator in a low-margin industry.

- Client stickiness. Multi-year contracts and tailored integrations make customer churn rare.

- Global reach. Operations in over 30 countries and relationships with multinational brands provide scale and visibility.

- Acquisition engine. Deals like Clipper and Wincanton have extended GXO’s presence in Europe and strengthened its reverse-logistics capabilities.

Risks and Challenges

- Debt pressure. With leverage above peers, any margin squeeze could affect refinancing and limit new acquisitions.

- Margin fragility. Rising labor and energy costs easily erode thin operating margins.

- Execution risk. Integrating large UK acquisitions while maintaining service quality is a tall order.

- Intense competition. DHL Supply Chain, Kuehne + Nagel, and DB Schenker compete aggressively for the same multinational contracts, keeping pricing power limited.