Google has a new antitrust headache, this time in the U.K., where the competition regulator opened an investigation to determine whether the company has Strategic Market Status (SMS) in general search and search advertising activities. If the regulator concludes Google has SMS, it will have a wide range of remedies at its disposal to address competition concerns, including requiring changes to Google’s business practices or even mandating divestitures

CMA’s New Powers

Since January 1, 2025, the UK’s Competition and Market Authority (CMA) has new powers to regulate digital markets, and in particular to investigate firms, impose new remedies and sanctions. The new Digital Markets, Competition and Consumers Act (DMCC) mirrors, in the essence, the powers and obligations established by the European Union’s Digital Markets Act (DMA).

The DMCC aims to equip the CMA with more effective tools to scrutinize tech giants like Google, Amazon, and Meta. Under the previous legal framework, the CMA was limited in its ability to investigate certain activities or mandate broad changes affecting entire industries rather than individual companies. With its expanded authority, the CMA now has a more robust toolkit to address competition concerns in digital markets.

However, these powers and obligations apply exclusively to companies designated as having Strategic Market Status (SMS)—a concept analogous to a “gatekeeper” under the DMA. To designate a company as having SMS, the CMA must first open an investigation, a process that can take up to nine months. During this investigation, the regulator must establish that the company operates a digital activity in the UK, possesses “substantial and entrenched market power,” and holds a position of strategic significance.

Difficult Elements to Prove, But Google Was Chosen for a Reason

The most difficult elements for the regulator to prove are market power and a position of strategic significance.

First, “substantial and entrenched market power”. Traditionally, regulators have spent more than 9 months to determine whether a company has market power in a digital market. On its face, this could be challenging for the CMA, but the regulator published on July 2020 a 437-page report on online platforms and digital advertising. In that report, the CMA concluded that Google was dominant, but fell short of imposing any remedies, due to limitations in the legal framework at the time.

It may not be a coincidence that Google was chosen for the first SMS investigation. The CMA’s previous work in these markets gives it a deep understanding of the issues at play. Although new data will be required, the sectors under scrutiny have not changed significantly since the report’s publication. The CMA may expect to uncover similar findings within the statutory deadline.

But the new legislation, while providing the regulator with new tools, it may also pose challenges. According to the regulators’ guidelines “in order to assess whether a firm has substantial and entrenched market power in respect of a digital activity, the CMA must assess carry out a forward-looking assessment of at least five years”.

This requirement adds complexity: the CMA must determine that a company holds market power currently and is likely to maintain it in the foreseeable future. For regulators, a forward-looking analysis entails making predictions, which are inherently uncertain and open to interpretation by the companies involved—and potentially by the courts.

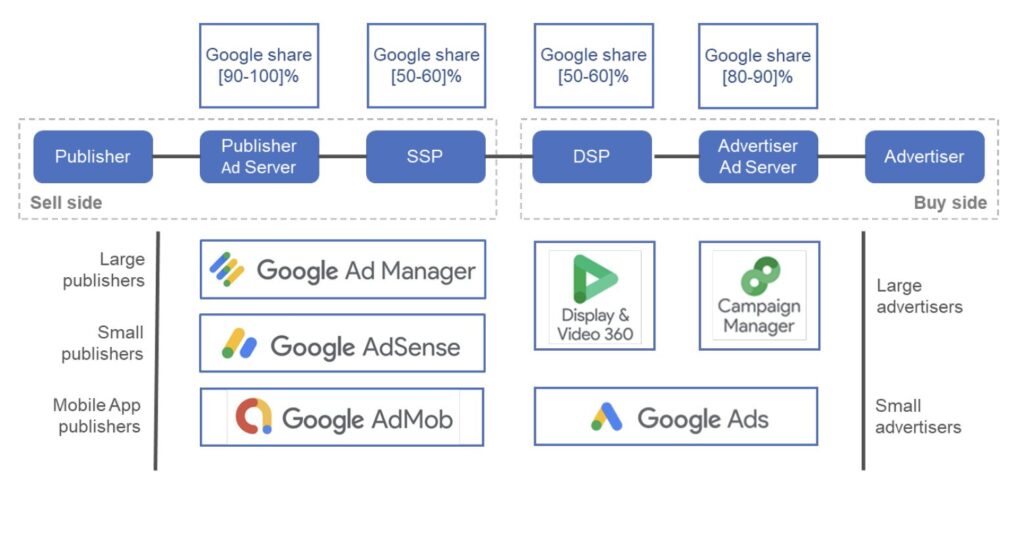

Last, but not least, the regulator needs to assess that a company has a “position of strategic significance”. This means to assess whether a company can extend its market power to other areas or products and can influence the ways in which other firms conduct themselves, in respect of the digital activity. In this regard, it is noticeable, that one entire section of the CMA’s 437-page report is dedicated to “Google’s expansion into other markets”, and the regulator concluded that “Google has the ability and incentive to leverage its market power from general search into related markets.” This existing analysis could provide a foundation for the CMA’s current investigation.

Remedies

If the CMA concludes its investigation by October and determines that Google holds SMS in the probed markets, it will have a wide range of remedies at its disposal to address any factors that “prevent, restrict, or distort competition.”

Based on the CMA’s notes on the investigation, potential remedies could include:

- Requiring Google to make the data it collects accessible to other businesses.

- Granting publishers greater control over how their data is used, including its application in Google’s AI services.

However, the DMCC, provides more tools including i) general restrictions on conduct (eg a prohibition on combining user data collected from different activities that the SMS firm carries out); ii) general obligations to be performed (eg a requirement to make a service interoperable with a competitor’s) or iii) acquisitions and divisions (eg a requirement to divest an aspect of the business).

Note For Investors

While this investigation may be small in scope to affect the worldwide turnover of Google (even assuming that the outcome is negative for the company), it may provide good insights about the development of the general search and search advertising businesses globally. Why?

Because for the CMA to prove whether Google has SMS in general search and search advertising, it will need to provide a prediction on how GenAI may impact this space in the next 5 years. The regulator will need to answer questions like, will Microsoft’ Bing have the potential to challenge Google’s dominance? Will GenAI be a potential replacement for search engines? If so, which companies are better place to take its market share? While the role of GenAI on Microsoft’s Bing is yet limited, its impact in five years will be difficult to assess.

Microsoft’s 1Q25 quarterly report, shows that the search and news advertising revenue increased 18%, partly, for a higher search volume. It is not specified if that increase is due to the integration of GenAI, but it is a noticeable increase.

What it seems undeniable is that consumers will likely change the way they use both search engines and generative AI and the regulator will have to give its opinion on this too.

Last, but not least, a prediction. Meta could be next.

While this investigation does not involve Meta, the CMA’s decision to focus on one of the companies and activities analyzed in its 437-page study could indicate that the regulator plans to leverage that data and expertise to address other areas. The other activities examined in the report were social media and display advertising, with Meta prominently in the spotlight.